jersey city property tax phone number

The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes. Get information about the NJ EITC Earned Income Tax.

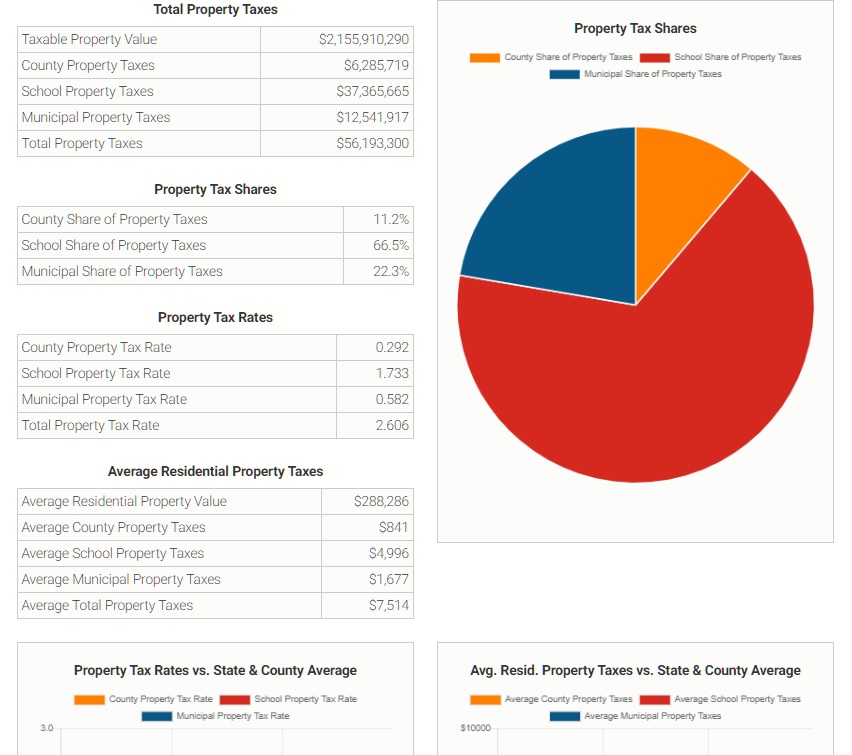

Infographic Jersey City Tax Base Tax Levies And Tax Rates Demystified Civic Parent

Please check your email address carefully before you send your message.

. 201 209-6755 Phone 201 459-9173 Fax 830 to 430 Mon - Fri 365 Summit Avenue Suite 219. NJ Division of Taxation PO Box 900 Trenton NJ 08646-0900. A-Z of States of Jersey departmental contacts.

Automated Phone Numbers. For more information please contact the Assessment Office at 609-989-3083. NJ Division of Taxation PO Box 900 Trenton NJ 08646-0900.

Left click on Records Search. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Jersey City NJ 07305.

TO VIEW PROPERTY TAX ASSESSMENTS. Risk Management 201 547. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON.

Address and Phone Number for Jersey City New Jersey IRS Office an IRS Office at Montgomery Street Jersey NJ. Main Customer Service Center - 609-292-6400. Account Number Block Lot Qualifier Property Location 18 14502 00011 20.

For your convenience property tax forms are available online at our Virtual Property Tax Form Center. 11 rows City of Jersey City. Have your tax questions answered by a Division representative.

Online Inquiry Payment. Eduardo CToloza CTA City Assessor. Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm.

Online Inquiry Payment. Automated Phone Numbers. City of Jersey City Tax Collector 280 Grove St Rm 101 JC NJ 07302 Checking Account Debit - Download complete and send the automated clearing house ACH Payment Authorization.

Jersey City NJ 07302 Tel. Jersey City Launches First Food Rescue Mapping. Saving Taxpayer Dollars Fighting.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Under Tax Records Search select. Jersey Citys On-demand Affordable Public Transit Service Via Surpasses 1 Million Rides Learn More.

1-800-882-6597 within NJ NY PA DE and MD Office hours are. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program. City of Jersey City.

Jersey City New Jersey IRS Office Contact Information. Store or any building shall display the street number pursuant to City Code 108-5. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

When you contact the Division of Taxation through the website. When contacting City of Jersey City about your property taxes make sure that you are contacting the correct office.

New Jersey Residents Can Now Prepay Their Property Taxes 6abc Philadelphia

New Jersey Education Aid Why Jersey City S New Unpiloted Skyscraper Will Help Taxpayers Not Necessarily The Public Schools

City Of Jersey City Official Government Page Facebook

City Council To Vote On 724 8 Million Jersey City Budget Tuesday Nj Com

Jersey City Mayor Takes Shot At School District Spending In Property Tax Bill Letter Nj Com

Average Nj Property Tax Bill Rose Again In 2020 Nj Spotlight News

New Jersey Education Aid Jersey City S Property Taxes Are State S Most Unfair Is Anyone Surprised

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Jersey City To Refund Property Owners For Arts Tax Overcharge Jersey City Nj Patch

Jersey City New Jersey Wikipedia

Property Taxes City Of Jersey City

Fair Property Taxes For All Nj Launches New Property Tax Viewer Insider Nj

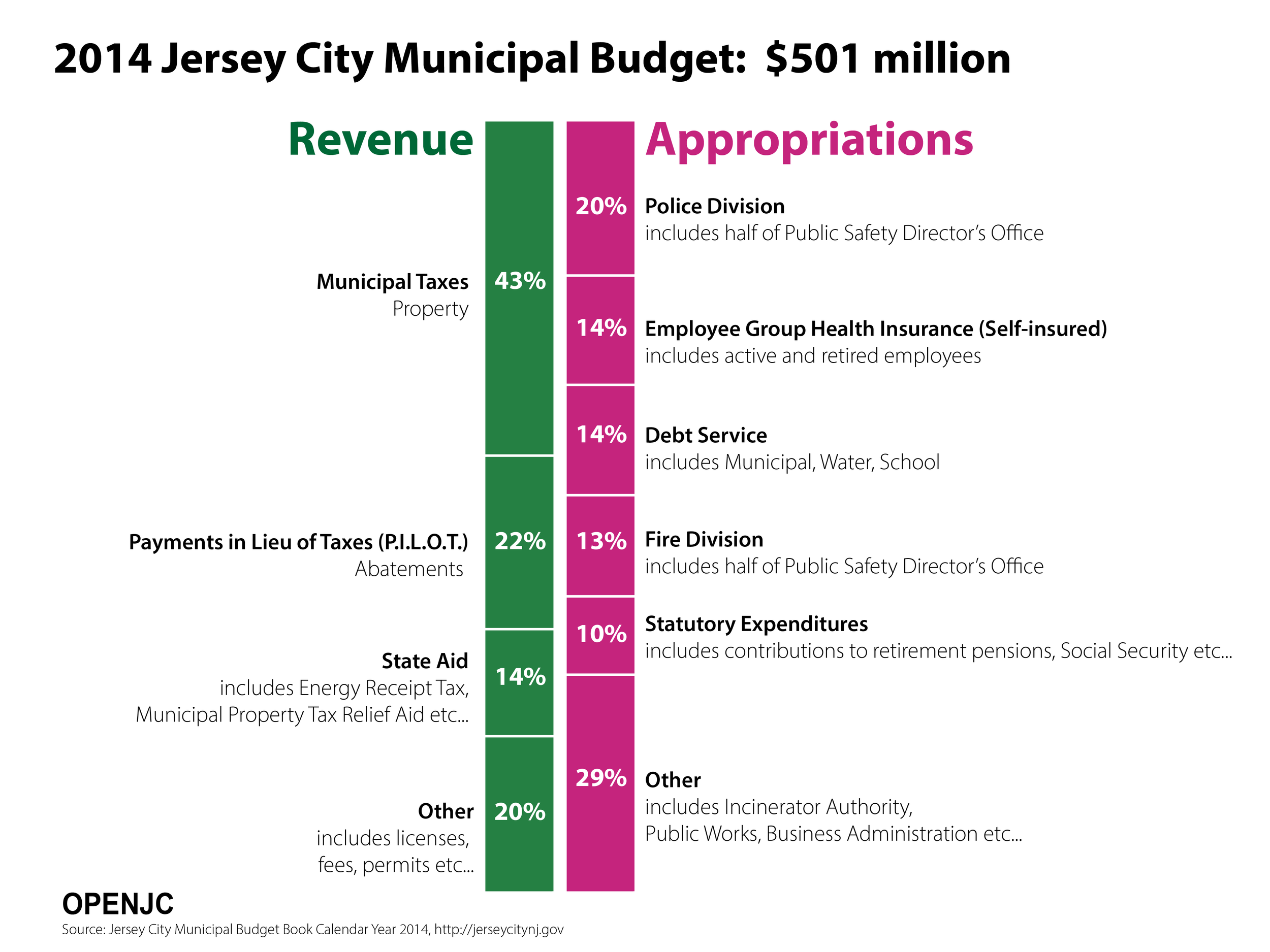

Jersey City 2014 Budget In 4 Easy Graphs Visualizing Economics

Jersey City New Jersey Wikipedia

Why Is Mayor Steven Fulop Responsible For Your 1000 Property Tax Increase

Property Tax Hike Likely Coming To Roughly One Third Of Jersey City Pix11